Succession Planning That Protects Your Business Dreams

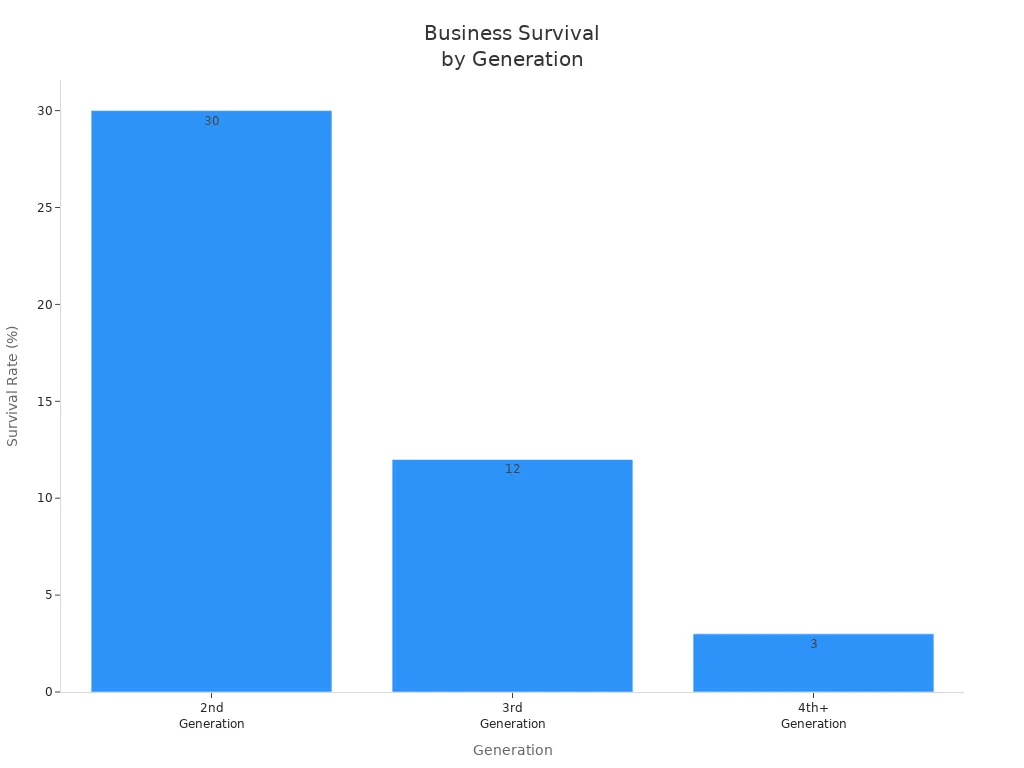

Succession Planning safeguards business dreams by preparing companies for unexpected events like death, disability, divorce, disagreement, and distress. When leaders fail to plan, nearly two-thirds of family businesses lack a documented strategy, which leads to low survival rates across generations:

Generation | Survival Rate |

|---|---|

2nd | 30% |

3rd | 12% |

4th+ | 3% |

Effective Hiring Systems and sound Business Management help companies avoid leadership gaps and protect Sales. Planning for these risks secures a lasting legacy.

Key Takeaways

Succession Planning is essential for business continuity. It prepares organizations for unexpected leadership changes.

Two-thirds of family businesses lack a documented succession plan, leading to low survival rates across generations.

Effective Succession Planning reduces turnover and helps develop future leaders, ensuring stability and growth.

Regularly review and update your succession plan to keep it relevant. Changes in leadership or business dynamics require adjustments.

Involve key stakeholders in the planning process. Their input fosters trust and ensures smoother transitions.

Clear communication about the succession plan builds confidence among employees and stakeholders, reducing uncertainty.

Utilize external advisors for objective insights and legal compliance. Their expertise can prevent costly mistakes.

Start planning early to identify potential successors and provide them with necessary development opportunities.

Succession Planning Overview

What Is Succession Planning

Succession Planning is a process and strategy for replacement planning or passing on leadership roles. Companies use this approach to identify and develop potential leaders who can fill key positions when they become vacant. This process helps organizations prepare for changes in leadership and ensures that business operations continue smoothly. Succession Planning is a long-term effort that focuses on developing individuals who can step into important roles when needed. By planning ahead, businesses protect their future and maintain stability.

Why It Matters

Succession Planning plays a vital role in business continuity. Many industry experts agree that a strong plan supports long-term stability by maintaining a steady flow of skilled leadership. It reduces turnover and provides growth opportunities, which helps companies develop future leaders. Businesses face risks from unexpected events, often called the "5 Ds": Death, Disability, Divorce, Disagreement, and Distress. These events can disrupt operations and threaten the company's future. Succession Planning allows organizations to anticipate sudden changes, preserve tasks and knowledge, and prepare individuals for new responsibilities.

Succession Planning builds resilience in businesses. It prepares them for both expected and unexpected leadership changes, ensuring that the right people are ready to step up. This approach helps retain top talent and cultivates leaders from within, which is crucial for long-term success.

Business owners often cite several reasons for implementing Succession Planning:

Preparing future leaders early to ensure readiness for new roles.

Creating opportunities for career advancement to reduce employee attrition.

Addressing the risk of losing talent due to lack of engagement.

Types of Plans

Companies use different types of Succession Planning to meet their needs. The most common types include:

Succession Plan Type | Key Focus Areas |

|---|---|

Family Transition | Successor identification and development are primary focuses. |

Internal Sale | Requires structured timelines and comprehensive documentation. |

External Sale | Prioritizes defined timelines and robust business valuations. |

Other approaches include:

Defined departure: Planning for known exits of key executives.

Ongoing: Continuous assessment and development of potential successors.

Emergency or interim: Plans for unexpected transitions to ensure operational continuity.

Each type of plan helps businesses prepare for leadership changes and maintain continuity. Succession Planning facilitates knowledge transfer and prevents loss of critical information during transitions. By choosing the right plan, companies can protect their legacy and secure their future.

Risks and Benefits

Risks Without a Plan

Leadership Gaps

When a business lacks a clear plan for leadership changes, confusion often follows. Leadership gaps can disrupt business continuity and slow down decision-making. Departments may clash as they wait for direction. Employees may feel uncertain about their future, which can lead to high turnover. Top talent often leaves for more stable opportunities. Contracts may lapse, causing immediate financial losses. Customers may look elsewhere, reducing the value of the business. In family-owned companies, power struggles can arise, sometimes leading to legal disputes. Without a plan, a forced sale at a steep discount may become the only option.

Leadership confusion and operational delays can weaken even the strongest organizations. A lack of planning often results in lost knowledge and broken team cohesion.

Loss of Vision

A business without a succession plan risks losing its original vision. When leadership changes suddenly, the new leaders may not understand or value the company’s goals. This loss of direction can cause the business to drift away from its core mission. Stakeholders, including employees and customers, may lose trust. The business value can drop overnight, and the company may struggle to recover. Poor planning almost always leads to negative impacts on the organization.

Benefits of Planning

Continuity

Succession Planning helps businesses maintain stability during transitions. Companies with strong systems and teams, such as those at "systems and teams," use structured plans to ensure that leadership changes do not disrupt daily operations. These organizations develop internal talent pipelines, which allow them to adapt quickly to market changes and new technologies. A formal plan also helps preserve institutional knowledge and keeps the business moving forward.

Benefit Description | Measurable Impact |

|---|---|

Increased Profits | Companies that use succession plans see 24% higher profits than those that don't. |

Employee Engagement | Companies with highly engaged teams are 21% more profitable than those with disengaged workforces. |

Reduced Hiring Costs | Developing internal talent cuts down recruitment expenses significantly, with replacement costs ranging from one-half to two times an employee's annual salary. |

Enhanced Leadership Diversity | A fair succession plan promotes equal access to growth opportunities, fostering diverse leadership teams. |

Improved Organizational Agility | A pipeline of talented individuals enables organizations to adapt quickly to market changes and new technologies. |

Stakeholder Protection

A well-communicated succession plan protects everyone involved with the business. Employees feel secure about their jobs, and customers trust that service will remain reliable. Investors gain confidence in the company’s future. Transparent communication reduces uncertainty and minimizes conflicts during leadership transitions. At "systems and teams," clients benefit from clear plans that align all stakeholders and support long-term growth. By identifying and nurturing high-potential employees, these organizations build strong teams ready to handle unexpected changes.

Succession Planning ensures that businesses can weather unexpected events, protect their vision, and support everyone who depends on their success.

Succession Planning Steps

Identify Key Roles

Organizations begin Succession Planning by pinpointing the most critical positions. These roles often have a direct impact on business operations and continuity. Leaders use several criteria to determine which positions require immediate attention. The following table outlines effective criteria for identifying key roles:

Criteria | Description |

|---|---|

Urgency of Succession | How soon a position may become vacant, signaling the need for quick planning. |

Impact on Business Operations | The effect a vacancy would have on daily activities or revenue, highlighting essential roles. |

Unique Skillset or Knowledge Base | Specialized skills or knowledge that are difficult to replace, making the role vital. |

Internal Bench Strength | Availability of qualified internal candidates who can step in, reducing risks. |

Availability of External Candidates | Difficulty in finding suitable external candidates, increasing the need for internal planning. |

Leaders often use tools and frameworks to map out these positions. Common approaches include:

Succession planning tools, ranging from simple spreadsheets to advanced platforms with analytics.

The 9 box grid framework, which evaluates employees based on performance and potential.

Job Architecture frameworks, which organize roles and define relationships within the company.

These methods help organizations visualize their talent landscape and prepare for future changes.

Tip: Regularly review key roles to ensure the plan stays relevant as the business evolves.

Develop Talent Pipeline

Building a strong talent pipeline ensures leadership continuity. Organizations identify high-potential employees using formal assessments. They conduct regular talent reviews to evaluate readiness for advancement. Targeted development programs, such as mentorship and stretch assignments, help candidates gain necessary skills.

Best practices for developing a talent pipeline include:

Identify high-potential talent through structured evaluations.

Conduct talent reviews to track growth and readiness.

Offer targeted development, including mentorship and challenging projects.

Continuously evaluate readiness for future roles.

Maintain ongoing communication with candidates, providing feedback and support.

Support talent beyond development by offering resources and advocacy.

Organizations measure the effectiveness of their talent development programs using several metrics:

Measurement Area | Metrics/Activities |

|---|---|

Track Activity | Feedback, development plans, class attendance, identification of high-potentials, successor pools. |

Track Engagement | Employee value of development, organizational care for careers, intent-to-quit measures. |

Track Subsequent Performance | Improved performance, leadership competencies, internal filling of executive openings, turnover rates. |

Quality of the Program | Manager satisfaction, feedback on activities, time to fill positions. |

Return on Investment | ROI of training and development activities. |

Level of Effectiveness | Quality of talent pool candidates, speed of filling management positions. |

Satisfaction | Manager satisfaction with new hires and selection processes. |

Volume | Percentage of high-potential employees at risk of leaving, rate of successful internal promotions. |

Cost | Cost comparison of external hires versus internal promotions. |

Organizations that invest in talent development see higher employee retention. Many employees leave jobs due to lack of growth opportunities. Regular investment in development helps keep top talent engaged and ready for future leadership roles.

Document Processes

Thorough documentation of business processes reduces risks during leadership transitions. Organizations create formal succession plans that outline how successors are identified, developed, and prepared. Senior leadership involvement adds credibility and authority to the process.

Effective documentation methods include:

Documentation Method | Description |

|---|---|

Develop a formal succession plan | Structured document detailing identification, development, and preparation of successors. |

Involve senior leadership | Participation of top leaders to ensure credibility and support. |

Identify key positions and skills | Clear definition of critical roles and required skills using job analysis techniques. |

Communicate the plan | Transparent sharing of the process and outcomes with stakeholders. |

Organizations also document:

Criteria for selecting and evaluating successor candidates.

Succession timelines aligned with business cycles and contingencies.

Emergency protocols for sudden departures.

Allocation of roles and responsibilities during and after transitions.

Note: Clear documentation helps manage expectations and ensures a smooth handover when leadership changes occur.

Legal and Financial Prep

Legal and financial preparation forms the backbone of a robust succession plan. Business owners must address several critical steps to ensure a smooth transition and protect their legacy. The process begins with a thorough review of the family balance sheet. Proper asset titling helps prevent future disputes and ensures that ownership transfers as intended. Owners should keep business valuations current. Accurate valuations support fair transfers and help with tax planning.

A comprehensive approach includes examining operating and shareholder agreements. These documents may contain restrictions that affect succession. Regular reviews help identify potential issues before they become obstacles. Estate planning integration is essential. Merging business interests into personal estate plans respects both personal and business legacies.

Step | Description |

|---|---|

Estate Planning Integration | Merging business into estate plans ensures personal and business legacies are respected. |

Tax Implications | Proactive tax planning is essential to navigate estate and capital gains taxes during transitions. |

Intellectual Property Protection | Clearly defining the transfer of IP rights prevents future disputes and protects innovations. |

Business owners should also review individual estate plans for each family member. Identifying fiduciary and advisory roles clarifies responsibilities and supports a smooth transition. Keeping all documents up-to-date reduces confusion and legal risk.

Legal and financial advisors play a vital role in Succession Planning. They provide tailored services to meet unique business needs. Advisors help create trusts and wills, minimizing taxes and legal complications. They prepare heirs to manage their inheritance, offering education and support. Advisors also assess business value, collaborate on legal structures, and identify financial risks. Their expertise ensures that the succession process runs smoothly and protects the interests of all parties.

Tip: Regular legal and financial reviews help prevent unwanted surprises and provide peace of mind for business owners and their families.

Communicate Plan

Clear communication is essential for successful succession planning. Organizations must define key roles and assign communication responsibilities. Early engagement with potential successors builds trust and prepares them for future leadership. Open dialogue supports tailored development plans and helps successors understand expectations.

Effective communication strategies include proactive outreach to stakeholders. Regular updates and feedback sessions address concerns and keep everyone informed. Consistent messaging reinforces the core values and goals of the succession plan. Stakeholder education provides comprehensive information, helping everyone understand the process and their role in it.

Strategy | Description |

|---|---|

Proactive Outreach | Regularly reach out to stakeholders to solicit ongoing feedback, addressing concerns promptly. |

Message Consistency | Ensure that all communications are aligned and consistent, reinforcing core messages. |

Stakeholder Education | Provide comprehensive information sharing to enhance understanding of the succession process. |

Cultural Sensitivity | Tailor communication strategies to respect diverse cultural backgrounds. |

Organizations should establish a succession governance framework. This framework outlines how the plan will be communicated and monitored. Transparent communication fosters trust among employees. It manages expectations by clearly outlining the selection process and reduces uncertainty during leadership transitions. Employees feel valued and informed about their career paths, which boosts morale.

Note: Transparent communication helps organizations gain acceptance for succession plans and supports a positive workplace culture.

Common Mistakes

Delaying Planning

Many business owners delay succession planning, which can put the future of their company at risk. Several reasons often lead to this delay:

Overconfidence: Owners believe they have a plan in their head and do not see the need to document it.

Procrastination: They treat succession planning as a task for the distant future, often waiting until retirement is near.

Short-term Focus: Owners focus on daily operations and immediate challenges, pushing long-term planning aside.

Indecision: Uncertainty about whether to sell, liquidate, or pass the business to a successor causes hesitation.

Fear: Emotional attachment to the business makes it hard for owners to imagine stepping away.

Delaying succession planning can leave a business vulnerable to sudden changes. Without a clear plan, companies may face leadership gaps, confusion, and even financial loss.

Excluding Key People

Excluding important individuals from the succession planning process can create serious problems. When leaders do not involve key personnel, the business may experience:

Operational disruptions that slow down or halt daily activities

Conflicts among potential successors or family members

Diminished business value as uncertainty grows

Loss of customer confidence and trust

Potential job losses for employees

Other negative outcomes include increased expenses for recruiting and training new leaders, lost productivity, and a higher risk of legal issues. Disruptions in leadership can also lead to a loss of institutional knowledge and talent shortages. These problems decrease organizational stability and can damage relationships with both employees and customers.

Involving key people in the process helps maintain stability and ensures a smoother transition when leadership changes occur.

Ignoring Legal Details

Legal oversights in succession planning can lead to costly disputes and even business failure. The following table highlights common legal mistakes and their impact:

Evidence Description | Impact on Business |

|---|---|

Leads to disputes over control and decision-making authority. | |

Lack of documentation | Results in verbal promises that are not legally recognized, causing conflicts. |

Family conflicts | Personal emotions complicate business decisions, increasing the risk of disputes. |

When owners ignore legal details, they risk leaving the business open to challenges over ownership and control. Verbal agreements may not hold up in court, and family disagreements can escalate quickly. Proper legal documentation protects the business and ensures that everyone understands their roles and rights.

Regular legal reviews and clear documentation help prevent misunderstandings and protect the company’s future.

Not Updating Plan

Many business owners create a succession plan and then forget about it. They believe the plan will work for years without changes. This mistake can put the future of the business at risk. Companies grow, people change, and new challenges appear. A plan that worked last year may not fit today’s needs.

Succession plans need regular reviews. Experts recommend updating these plans every three to five years. Major life events, such as marriage, divorce, or the birth of a child, can also require immediate updates. Business changes like rapid growth, new partnerships, or leadership shifts should prompt a review. Owners who ignore these signals may leave their company exposed to unexpected problems.

Regular updates keep succession plans relevant and effective. They help businesses respond to new risks and opportunities.

A plan that is not updated can cause confusion. Successors may not know their roles. Employees may feel uncertain about their future. Outdated plans can lead to legal disputes or financial losses. The company may lose its vision if new leaders do not understand current goals.

Common signs that a succession plan needs updating include:

Changes in ownership or management structure

Addition or departure of key employees

Expansion into new markets or products

Shifts in family dynamics or relationships

Changes in laws or regulations

Business owners should set reminders to review their plans. They can use a simple checklist to track important updates:

Review Checklist | Action Needed |

|---|---|

Leadership changes | Update successor list |

Business growth | Adjust roles and responsibilities |

Family events | Revise ownership and estate plans |

Legal or tax changes | Consult advisors |

New partnerships | Amend agreements |

Owners should involve advisors, family members, and key employees in the review process. Open communication helps everyone understand the plan and their role in it. Regular updates show that the business values its people and prepares for the future.

Tip: Treat your succession plan like a living document. Update it as your business and family change.

A current succession plan protects the company’s vision and legacy. It gives employees confidence and keeps operations running smoothly. Owners who review and update their plans regularly build stronger, more resilient businesses.

Best Practices

Start Early

Successful succession planning begins long before a transition becomes necessary. Companies that start early can prepare for unexpected changes and avoid disruptions. Early planning allows leaders to identify potential successors and provide them with the right experiences. This approach also helps businesses stay stable during leadership transitions.

The following table highlights why early planning matters:

Evidence | Description |

|---|---|

Proactive Strategies | Starting early prepares organizations for sudden changes, ensuring stability during transitions. |

Financial Impact | Poor planning can cause significant financial losses, making early and ongoing planning crucial. |

Many organizations wait too long to create a plan. When leaders leave suddenly, businesses without a plan often struggle. Early succession planning gives companies time to develop talent, document processes, and address legal or financial issues. This proactive approach protects the business and its people.

Tip: Begin succession planning as soon as possible, even if leadership changes seem far away.

Leadership Development

Developing future leaders is a key part of succession planning. Companies that invest in leadership programs build strong teams ready to step up when needed. General Electric’s 'GE Crotonville' program stands out as a model for success. This program uses rotational assignments, ongoing education, and real-world training to prepare leaders for high-level roles.

Effective leadership development includes several important steps:

Create talent pools for middle and senior-level positions.

Engage successors in decision-making early.

Provide exposure to C-suite roles and leadership simulations.

Organizations can follow a clear process to develop leaders:

Use performance appraisals and leadership assessments to find potential candidates.

Create customized development plans for high-potential employees.

Hold regular meetings to discuss progress and adjust plans as needed.

These steps help companies build a strong pipeline of future leaders. Employees who receive training and new challenges feel valued and stay engaged. Leadership development also ensures that successors understand the company’s vision and values.

Investing in leadership development prepares organizations for smooth transitions and long-term success.

Clear Communication

Clear communication supports every stage of succession planning. Leaders must share the plan with key stakeholders and explain each person’s role. Open discussions help reduce confusion and build trust within the organization.

Companies should use regular updates to keep everyone informed. Feedback sessions allow employees to ask questions and share concerns. Consistent messaging ensures that everyone understands the goals and steps of the succession plan.

Communicate early and often with all stakeholders.

Use simple language to explain the plan.

Encourage questions and provide honest answers.

When organizations communicate clearly, employees feel secure about their future. Customers and investors also gain confidence in the company’s stability. Good communication helps prevent misunderstandings and supports a positive workplace culture.

Note: Clear and open communication is essential for successful succession planning and business continuity.

Use Advisors

External advisors play a vital role in succession planning. They bring specialized knowledge and impartial perspectives to the process. Many businesses rely on consultants, legal experts, and financial advisors to guide them through complex transitions. These professionals help owners make informed decisions that protect the future of the company.

Advisors offer unbiased assessments. They do not have personal stakes in the business, so their advice remains objective. This impartiality helps leaders see potential risks and opportunities more clearly. Advisors also ensure that succession plans meet legal requirements. They review documents, contracts, and agreements to prevent costly mistakes. Legal experts check that ownership transfers follow the law and that all parties understand their rights.

Consultants align succession strategies with business goals. They study the company’s objectives and recommend plans that support long-term growth. Advisors help owners set clear criteria for choosing successors. They suggest ways to develop talent and prepare future leaders. Their guidance keeps the business focused on its mission during times of change.

Family businesses often face unique challenges. Conflicts can arise when multiple family members want leadership roles. Advisors help reduce these conflicts by acting as neutral mediators. They facilitate discussions and encourage fair decision-making. This approach builds trust among family members and protects relationships.

Engaging outside consultants or coaches improves communication. Advisors organize meetings and workshops for stakeholders. These sessions encourage open dialogue and help everyone understand the succession plan. Advisors hold leaders accountable for following through on commitments. They track progress and suggest adjustments when needed.

Tip: Regular meetings with advisors keep succession plans on track and ensure that everyone stays informed.

The following table highlights key benefits of using external advisors in succession planning:

Benefit | Description |

|---|---|

Unbiased Assessments | Advisors provide objective evaluations of candidates and plans. |

Legal Compliance | Experts ensure all documents and processes meet legal standards. |

Goal Alignment | Consultants help match succession plans with business objectives. |

Conflict Mitigation | Advisors reduce family disputes and promote fair decision-making. |

Improved Communication | Outside experts foster open dialogue among stakeholders. |

Accountability | Advisors monitor progress and encourage leaders to follow the plan. |

Business owners should choose advisors with experience in succession planning. They should look for professionals who understand their industry and company culture. Owners can ask for references and review credentials before making a decision.

Advisors do not replace the leadership team. Instead, they support leaders by offering expert advice and practical solutions. Their involvement increases the chances of a smooth transition. Companies that use advisors often avoid common mistakes and build stronger succession plans.

Note: Advisors help businesses navigate complex transitions and protect their legacy for future generations.

Case Studies

Family Business

Many family businesses have shown how careful succession planning can protect a company’s future. The Walton family at Walmart has managed leadership changes across generations. They use a trust and a Family Council. These tools help them keep communication open and make decisions together. The Ford family at Ford Motor Company has also handled transitions well. They brought in Alan Mulally as an outside leader in 2006. His leadership helped Ford avoid bankruptcy and plan for stability. The Quandt family at BMW owns nearly half of the company. They have spent years preparing for leadership changes. Their planning has helped BMW stay strong in the global market.

Walmart: The Walton family balances family and professional management. They use a trust and a Family Council for decision-making.

Ford Motor Company: The Ford family brought in external leadership when needed. Alan Mulally’s role was key to Ford’s survival and future planning.

BMW: The Quandt family planned for smooth leadership changes. Their efforts helped BMW maintain its global position.

These examples show that family businesses can succeed when they plan ahead and use clear structures.

Corporate Example

Large corporations also face challenges with succession planning. Disney’s leadership transition showed the need for early planning and open communication. When Disney did not plan well, boardroom conflicts and unhappy shareholders followed. Walmart’s approach highlights the importance of clear criteria for choosing leaders. They focus on competence, not just family ties, which helps prevent nepotism. Apple’s experience with leadership changes stresses the need to prepare future leaders. By grooming successors, Apple kept its focus on innovation and smooth transitions.

Disney: Early planning and transparent communication are vital. Poor planning can lead to conflicts and dissatisfaction.

Walmart: Clear criteria for succession help avoid nepotism and ensure competent leadership.

Apple: Preparing future leaders supports innovation and smooth transitions.

Bob Iger’s successor selection at Disney offers another lesson. Choosing a leader without considering the right qualities led to weaker company performance. Careful selection and support for new leaders are essential.

Lessons Learned

History teaches several important lessons about succession planning. Strong corporate governance helps companies manage transitions. Leaders must follow a clear succession plan and share responsibility. Open communication and early planning prevent confusion and conflict. Companies that prepare successors and set clear criteria for leadership choices see better results. Family businesses and large corporations both benefit from planning, transparency, and support for new leaders.

Succession planning works best when companies start early, communicate openly, and choose leaders based on skills and values. These steps help protect business dreams and ensure long-term success.

Get Started

First Steps

Starting succession planning can feel overwhelming, but breaking it down into clear steps makes the process manageable. Every business, no matter its size, can take these actions to build a strong foundation for future leadership.

Identify critical roles

Leaders should list the positions that are essential for business continuity. These roles often have a direct impact on daily operations and long-term goals.Define required competencies and skill sets

Each key role needs specific skills. Companies should outline what knowledge and abilities successors must have to succeed.Organize career paths for high-potential employees

Businesses can map out growth opportunities for team members who show leadership promise. This step helps employees see a future within the organization.Establish a development program opportunity

Training and mentorship programs prepare future leaders. These programs give employees the experience and confidence needed for advancement.Create a succession planning template and toolkit

A structured template keeps the process organized. Toolkits may include checklists, forms, and guidelines for evaluating candidates.Monitor progress and performance metrics

Regular reviews help track development and readiness. Companies can adjust plans based on feedback and measurable results.Engage stakeholders and the leadership team in succession efforts

Involving key people ensures support and alignment. Open discussions build trust and clarify expectations.

Tip: Taking these first steps early helps businesses avoid disruption and protect their legacy.

Resources

Many organizations find value in using practical tools and expert guidance during succession planning. The following resources can support a smooth process:

Resource Type | Description |

|---|---|

Succession Planning Templates | Ready-made forms and checklists to organize planning activities. |

Leadership Development Programs | Workshops and courses that build essential skills for future leaders. |

Professional Advisors | Legal, financial, and HR experts who offer tailored advice and support. |

Industry Associations | Groups that provide best practices, networking, and educational materials. |

Online Toolkits | Digital resources with guides, templates, and planning frameworks. |

Note: Companies like "systems and teams" offer specialized support for businesses starting or improving their succession plans. Their expertise helps organizations navigate complex transitions and secure long-term success.

For those who want to learn more about succession planning or need help getting started, reaching out to experienced advisors can make a significant difference. Taking action today ensures that business dreams remain protected for generations to come.

Succession Planning protects business dreams by preparing companies for change. Leaders who act early build stronger teams and secure their legacy. Companies that update plans and communicate clearly avoid confusion and risk.

Start planning today to keep your business vision alive for future generations.

FAQ

What is the main goal of succession planning?

Succession planning prepares a business for leadership changes. It helps companies identify and develop future leaders. This process protects the company’s vision and ensures smooth transitions.

How often should a business update its succession plan?

Experts recommend reviewing succession plans every three to five years. Major events, such as leadership changes or business growth, may require immediate updates.

Who should be involved in succession planning?

Business owners, key leaders, and potential successors should participate. Legal and financial advisors also play important roles. Involving the right people ensures a strong and effective plan.

What happens if a company does not have a succession plan?

Without a plan, companies risk leadership gaps, confusion, and loss of business value. Employees may feel uncertain, and customers may lose trust.

Can small businesses benefit from succession planning?

Yes. Small businesses gain stability and protect their legacy with a clear plan. Succession planning helps owners prepare for unexpected changes and supports long-term growth.

How does succession planning support employee engagement?

Succession planning shows employees that the company values their growth. It creates opportunities for advancement and helps retain top talent.

What are the first steps to start succession planning?

Leaders should identify key roles, define required skills, and create development programs. Regular reviews and open communication help keep the plan on track.

Is succession planning only for family businesses?

No. All types of businesses, including corporations and partnerships, benefit from succession planning. It helps every organization prepare for leadership changes.